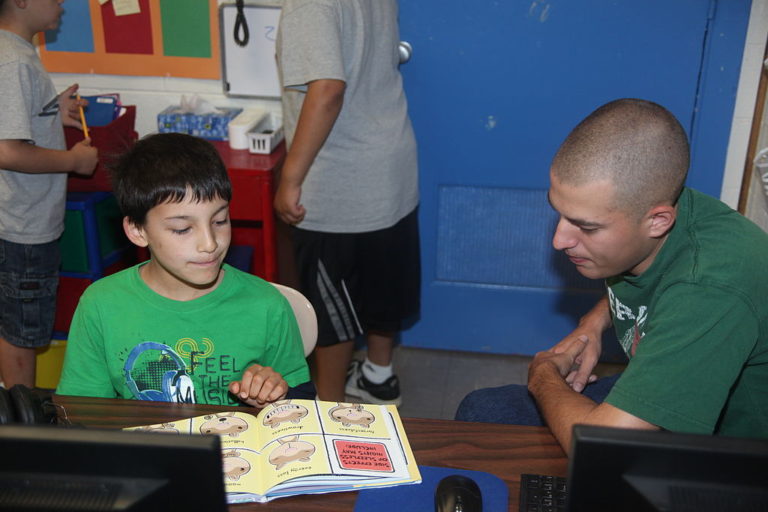

When is a casual employee really a permanent employee?

In Australian employment law matters, the real world substance of a work relationship often trumps what the contract says.

For example, sometimes people called independent contractors in contracts are really employees. Similarly, sometimes people called casual employees in contracts are really permanent employees – a point recently made clear by the Full Court of the Federal Court of Australia (the Court) in WorkPac Pty Limited v Skene (see case citation and link below).

Casual v permanent employee: Why does it matter?

Unlike permanent employees, casual employees are not entitled to lots of benefits under the Fair Work Act 2009 (Cth) (the FW Act), including paid leave, notice of termination, redundancy pay and paid holidays. To compensate for the lack of these entitlements, casual employees are paid a “casual loading”, currently 25% of base pay for Monday-Friday hours for speech pathologists in private practice under the Health Professionals and Support Services Award (see clause 26.2).

To be a true casual employee, the employee must have no advance commitment as to the duration of their employment or the days (or hours) worked. Some indicators of casual employment include:

-

irregular work patterns;

-

uncertainty as to the period over which employment is offered;

-

discontinuity; and

-

intermittency of work and unpredictability.

Can you side-step the issue by simply defining an employee as “casual” in their contract?

No.

Things like what the contract says, payments of casual loading, the need to submit timesheets, and the right to terminate at short notice (e.g. 1 hour) are relevant, but not of themselves decisive. Instead, what matters is the real world “objective” substance of the relationship between the employee and employer at the time. For example, there must be no long-term, firm, advance and mutual commitment to work an agreed pattern of hours.

What happens if the employer gets it wrong?

If the employee is really a permanent employee, she/he is entitled to annual leave and other entitlements under the National Employment Standards and/or the Award. In theory, employers should be able to set off any casual loading paid to the employee against these payments. But, in the Skene case, this didn’t happen because the employer had not designated a specific amount or percentage of wages to be casual loading.

Another consequence of getting it wrong is that the employer might be liable for penalties under the FW Act. The Court made it clear that ignorance of the law is no excuse, and that it’s a serious offence to mis-classify a permanent employee as a casual employee.

Bottom line

When deciding whether an employee is casual or permanent, Australian courts apply a substance over form test. Simply labelling an employee as “casual” in the employment contract and/or paying casual loading is not enough to guarantee the employee is truly casual from a legal perspective.

To mitigate the risk, employers should ensure that any casual loading paid to employees is specifically quantified in the employee’s contract and payslips. This may allow the employer to set-off that amount against any claimed entitlements. But the risk cannot be eliminated by legal drafting, as Courts will look at the true relationship between the employer and employee. Employers should therefore seek legal advice to assess the level of this risk for their businesses.

Case: WorkPac Pty Limited v Skene [2018] FCAFC 131. Full case access via the Federal Court of Australia website here.

Principal source: De Flamingh, J. & Kiley, E. (2018). Another casual conundrum: substance over form prevails (again), Law Society of NSW Journal, 72-74.

Image: httpss://tinyurl.com/ycvxcayp